We have officially moved past the "there’s an AI for that" phase. We have entered the "my AI handles that" era. 2024 was about experimenting with prompts. 2025 was about saving a few hours a week. 2026 is about a total operational rebuild.

The new objective is creating a lean, high-output machine you actually own rather than building a massive company with hundreds of employees. This guide provides the blueprint for staying lean, staying funded, and staying in control.

1. The Operational Shift: From "Assistants" to "Agents"

Transitioning from Assistants to Agents

In 2025, we used AI to write emails. In 2026, we use AI to manage outcomes. This shift requires a fundamental re-engineering of your team structure.

The Lean Agentic Stack

The 2026 winning team hires for orchestration rather than tasks. An AI-native startup today can reach $2M ARR with fewer than 5 human employees.

- The Workflow An Agentic Workflow autonomously identifies prospects, researches their latest SEC filings, and drafts a hyper-personalized pitch for human review. This replaces the old model of a human SDR finding leads and a human AE closing them.

- The Metric that Matters We look at Revenue Per Employee (RPE). Traditional SaaS benchmarks sit around $150k–$200k RPE. The 2026 founder targets $500k+.

Founder Insight If your AI is just chatting rather than executing multi-step tasks across your CRM, Slack, and Stripe, you aren't AI-native. You are just using a fancy typewriter.

2. The Funding Pivot

Control is the New Currency

The 2026 capital landscape is bifurcated. Massive compute-heavy AI companies still chase billion-dollar VC rounds. Application-layer startups are realizing equity is too expensive.

Revenue-Based Financing (RBF) vs. Traditional VC

| Feature | Revenue-Based Financing (RBF) | Traditional Venture Capital (VC) |

|---|---|---|

| Ownership | 100% Retained (Non-dilutive) | 15–25% Dilution per round |

| Repayment | Percentage of monthly revenue | Exit-based (IPO/Acquisition) |

| Speed | 48 hours to 2 weeks | 3 to 9 months |

| Governance | None (Founder stays in control) | Board seats and "Veto" rights |

| Best For | Scaling proven unit economics | "Moonshots" and R&D-heavy tech |

Why it matters now Interest rates have stabilized. The growth-at-all-costs era is over. RBF allows you to fund your marketing and inventory using today’s sales instead of selling 20% of your future empire to pay for a 2026 ad budget.

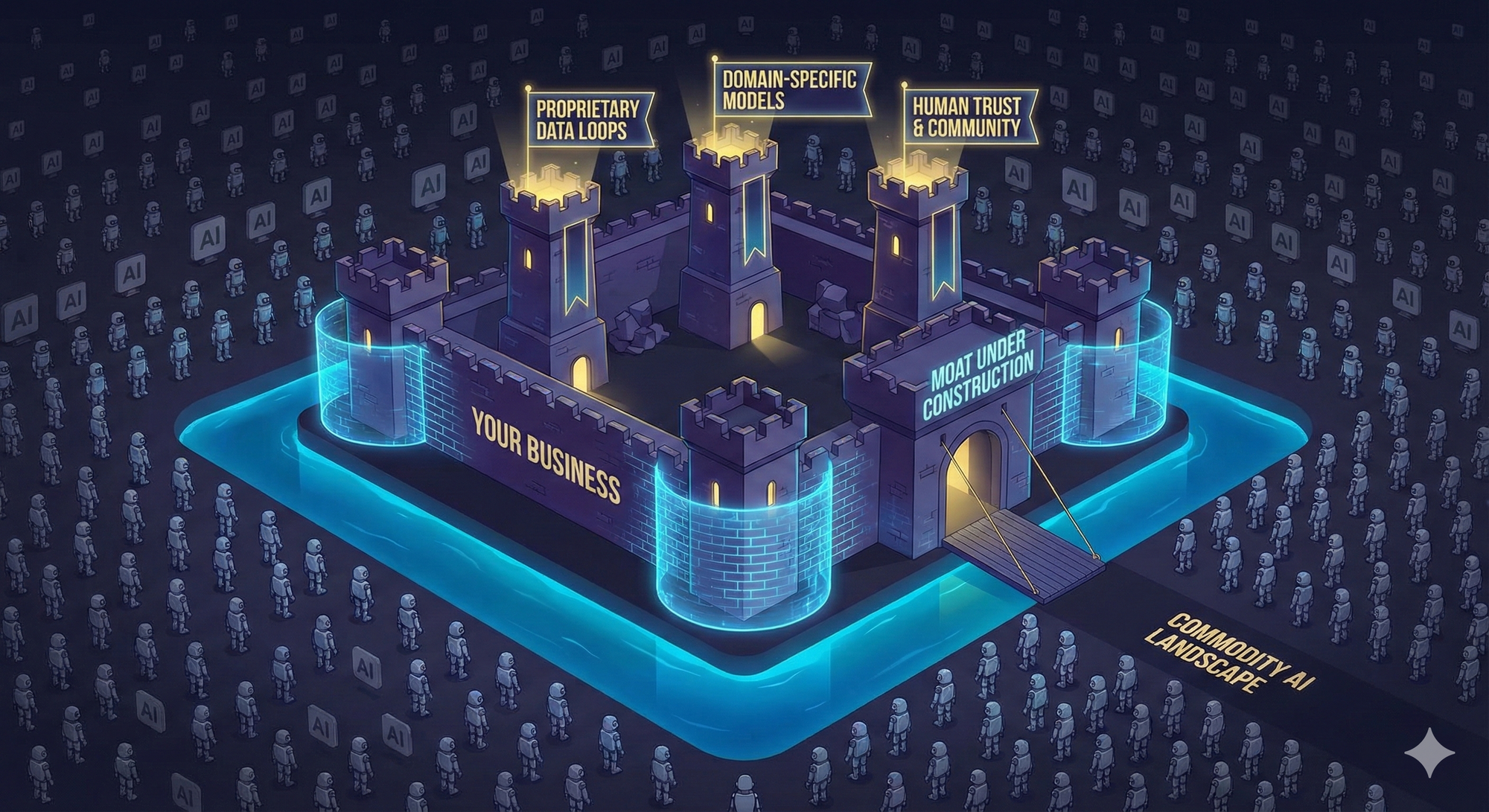

3. Building a "Moat" in the Age of Commodity AI

Any developer can spin up an LLM-powered app in a weekend. The 2026 founder builds moats in three specific areas to retain value.

- Proprietary Data Loops Your AI gets smarter every time a user interacts with it. This Data Flywheel makes your product harder to displace over time.

- Domain-Specific Models (DSLM) We are moving away from general models like GPT-5 or Claude 4. The value lies in fine-tuned models that understand the specific nuances of your industry.

- Human Trust & Community The web is flooded with 90% AI-generated content. Human-to-human connection is now a premium asset. Founders who build in public and foster real communities are the only ones immune to AI-cloning.

4. The Distribution Priority

Building Assets You Actually Own

Most startups die from a lack of customers rather than a lack of product. The 2026 founder solves distribution before writing the first line of code.

Moving Beyond Algorithms Social media platforms are volatile. We treat social media as top-of-funnel discovery while moving our best users to owned channels like newsletters or private communities. You need a direct line to your customers that an algorithm update cannot sever.

Community-Led Growth Your community is your most effective sales team. An engaged user base provides feedback and advocates for your brand organically. This dynamic creates a loop where your customers lower your acquisition costs for you.

Founder Insight An audience listens to you. A community talks to each other. The latter is infinitely more valuable for long-term retention.

5. Checklist

The First 30 Days of 2026

- [ ] Audit for Human-in-the-Loop Identify any process that requires a human to copy-paste data. Replace it with an agentic trigger.

- [ ] Test Alternative Debt Apply for a small RBF facility to understand your cost of capital compared to your cost of equity.

- [ ] Secure Your Owned Channel Launch a Substack or a Discord server. Move your first 100 followers off social media and into a database you own.

- [ ] Update your SEO for GEO Ensure your site uses Schema Markup so AI Search Engines like Perplexity and SearchGPT can cite you as a source.