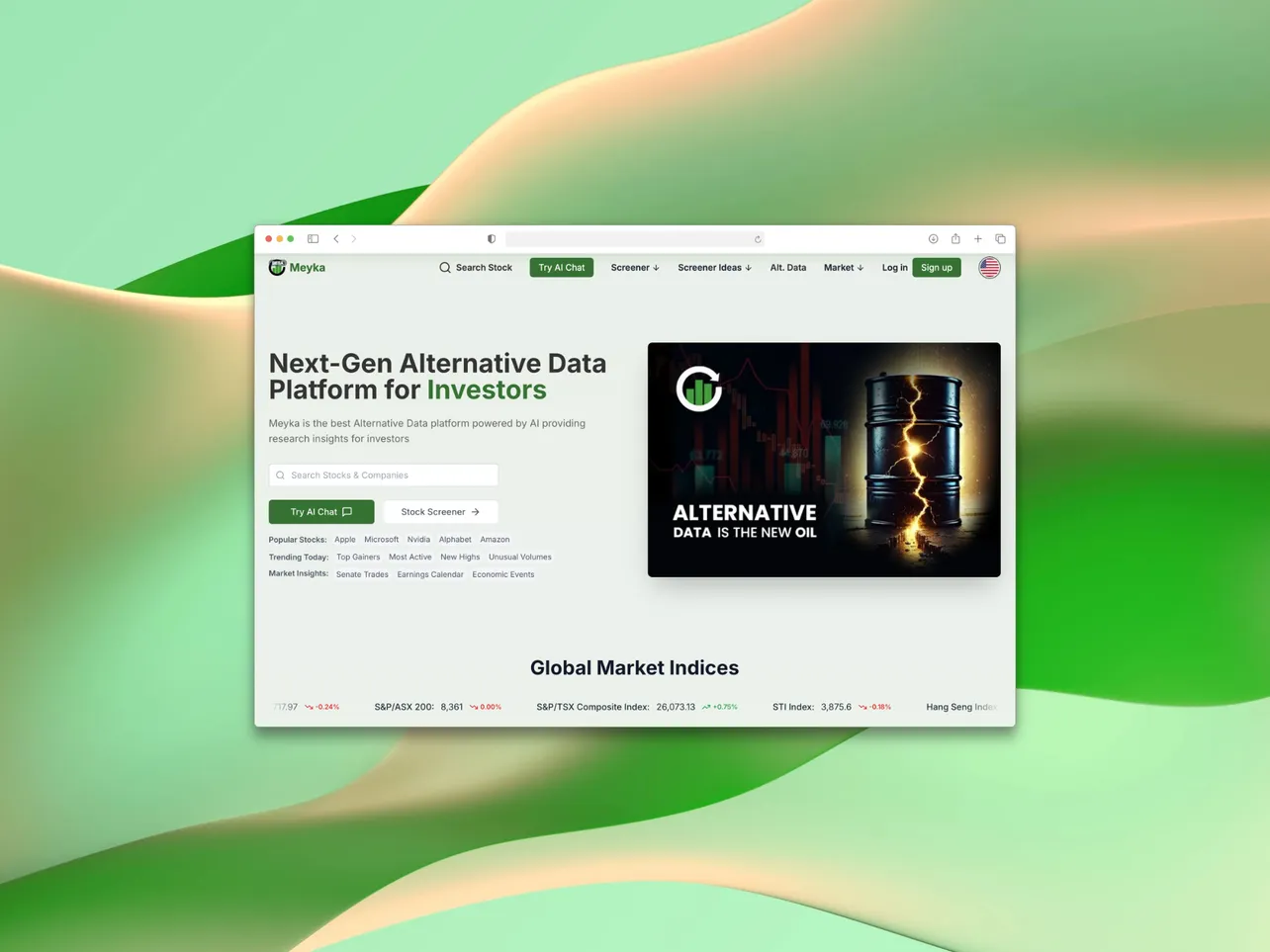

Meet Huzaifa Zahoor, the Australia-based founder behind Meyka AI, an AI-powered stock research platform that's making financial analysis accessible to everyone, from complete beginners to seasoned day traders.

The Problem: Financial Research Shouldn't Be Rocket Science

In investing and trading, it all comes down to information. But for many people, especially beginners, financial research can feel like a maze. Most tools are expensive, confusing, or built for professionals.

What exactly does Meyka AI solve?

"We are an AI-based stock research tool, and we're trying to create a system where beginners, day traders, and investors can easily search stocks based on our AI," explains Huzaifa.

The platform aims to level the playing field by making sophisticated stock analysis accessible to anyone, regardless of their experience level.

Think of it as having a financial analyst in your pocket. One that never sleeps, never gets tired, and can process vast amounts of market data in seconds to give you the insights you need.

The Spark: When ChatGPT Met Finance

Like many entrepreneurs, Huzaifa's journey began with a simple observation and a powerful "what if" moment.

What inspired you to start Meyka AI?

"I already have experience in stock market development, and after ChatGPT became common, I thought, why is there no system for finance that does the same thing we are trying to do?"

This is the classic entrepreneur's mindset: seeing a gap in the market and wondering why no one has yet filled it. Huzaifa had been working in stock market development, giving him insider knowledge of the pain points and inefficiencies in financial research.

When AI language models like ChatGPT demonstrated their ability to understand and explain complex topics in simple terms, the lightbulb went on. Why shouldn't there be an AI that could do the same for stocks and financial markets?

Building Momentum: 3,000 Users and Growing

Since launching, Meyka AI has been gaining steady traction in the competitive fintech space.

What's your current traction looking like?

"We have 3,000 monthly users per month, and we are free for now," Huzaifa shares.

This is a significant achievement for any startup, especially in the financial sector, where trust and credibility are paramount. The fact that they're attracting thousands of users while operating as a free platform suggests strong product-market fit and genuine value creation.

The freemium approach is smart for a few reasons:

- It lowers the barrier to entry for beginners who might be hesitant to pay for financial tools

- It allows the team to gather user feedback and iterate quickly

- It builds a substantial user base that can eventually convert to paid plans

The Turning Point: Early User Engagement

Every successful startup has that pivotal moment when things start to click. For Meyka AI, it came right after launch.

What's one decision or moment that changed everything for your startup?

"After launching, we got a lot of interaction from the early users," Huzaifa recalls.

This might sound simple, but user engagement is the holy grail for any new product. In fintech, getting users to sign up and engage with your platform is a strong sign you're on the right track.

It means the product isn't just solving a theoretical problem; it's solving a real one that people care enough about to use regularly.

Early user engagement often creates a virtuous cycle: engaged users provide feedback, which leads to product improvements, which attract more users, which creates more engagement, and so on.

The Road Ahead

While Huzaifa keeps his cards close to his chest about specific future plans, the foundation is clearly solid.

With 3,000 monthly users and strong early engagement, Meyka AI is positioned to make a real impact in democratizing financial research.

The timing couldn't be better. As retail investing continues to grow and more people take control of their financial futures, tools that make complex analysis simple and accessible will be increasingly valuable.

Connect with Huzaifa

Want to learn more about Meyka AI or follow Huzaifa's journey? You can find him on LinkedIn and other social media platforms.

For those interested in AI-powered financial research, Meyka AI shows an exciting glimpse into a future where sophisticated market analysis isn't just for Wall Street professionals.

It might just be for everyone.

Huzaifa Zahoor is the founder of Meyka AI, based in Australia. The platform currently serves 3,000 monthly users with AI-powered stock research tools designed for traders and investors of all experience levels.