(Note: This guide covers banking options for startups incorporated in the United States. If you are based in the UK or Europe, check out our guide on Revolut vs. Monzo vs. Wise [Coming soon])

Banking is boring. Until it isn't.

Most founders treat their bank account like a utility. They just want a place to store cash. Then they try to send a wire, issue a corporate card or integrate with QuickBooks and realize they made a mistake.

In 2026, a startup bank needs to do more than hold money. It needs to extend your runway. The old guard banks (Chase, Wells Fargo) are still clunky. They require branch visits and wet signatures. We don't have time for that.

The modern founder chooses between three fintech giants: Mercury, Brex and Relay. Here is how to choose the right financial stack for your specific business model.

The quick breakdown

- Mercury: Best for VC-backed tech startups and SaaS.

- Brex: Best for scaling companies that need heavy spend management.

- Relay: Best for bootstrapped teams and profit-focused founders.

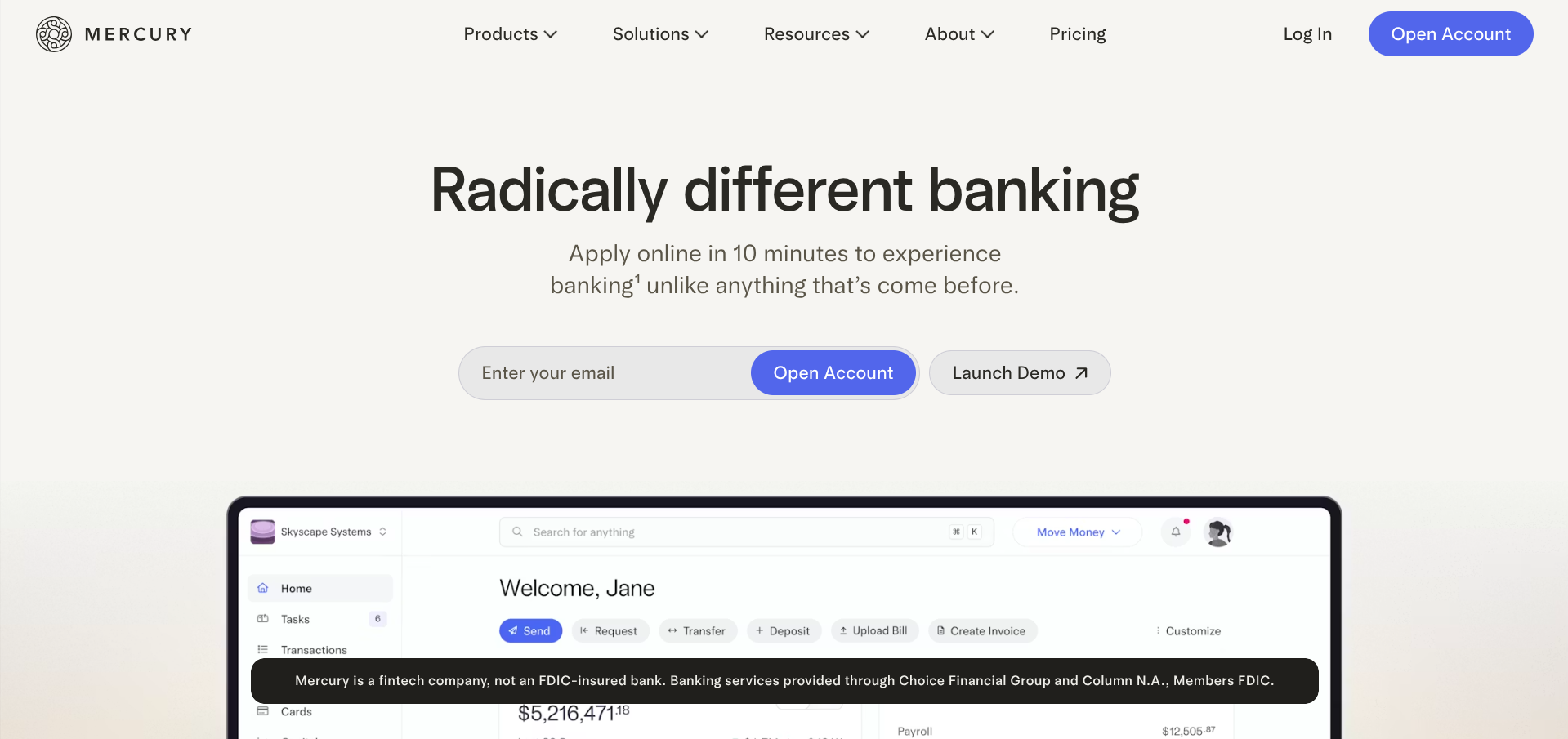

Mercury: The standard for tech

If you walk into a Y Combinator batch and ask what bank they use, most will say Mercury.

Mercury isn't technically a bank. It is a financial technology company that partners with FDIC-insured banks. This distinction matters because it allows them to build a user interface that feels like software, not a spreadsheet.

Why founders love it

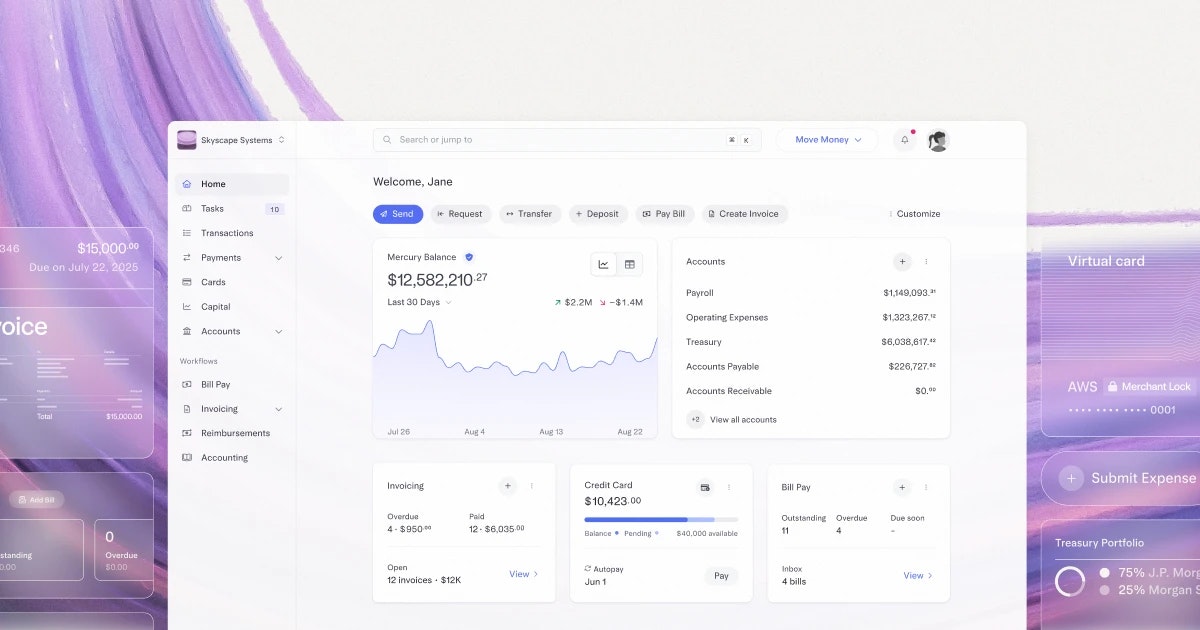

The interface is beautiful. It is clean, fast and intuitive.

Their "Treasury" product is a major selling point. If you raise a seed round and have $2 million in cash, you don't want it sitting idle. Mercury Treasury automatically moves that money into government-backed securities to earn yield. It is safety and profit on autopilot.

They also have "Mercury Raise," a program that connects founders with investors. They actively try to help you grow.

The catch

Mercury is very tech-focused. If you run a dropshipping business or a local agency, they might be less likely to approve your account compared to a generic option.

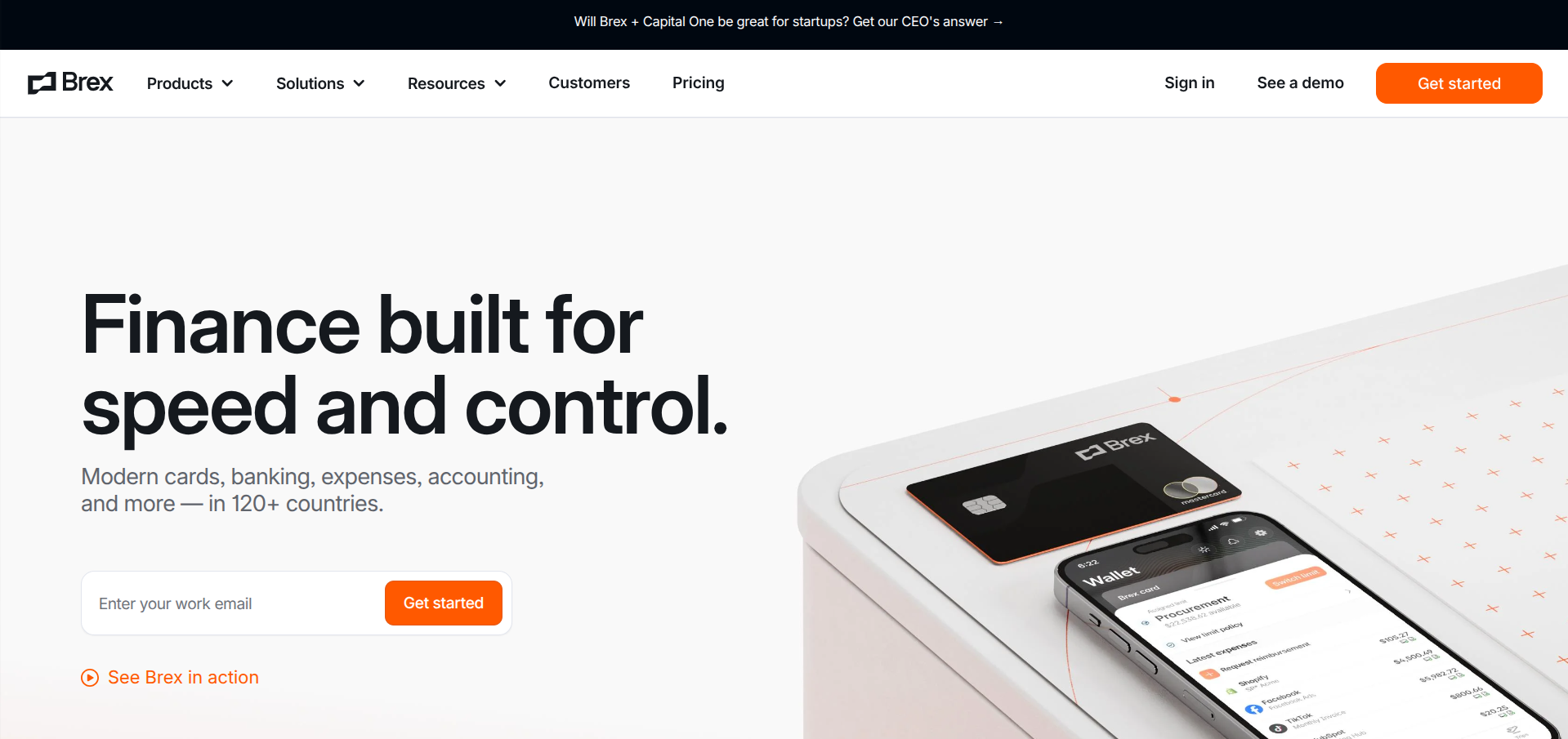

Brex: The engine for scale

Brex started as a corporate card for startups. They realized that nobody would give credit to a company with no credit history, even if they had millions in the bank.

Brex fixed that. Now they are a full financial stack.

Why scaling teams love it

Brex shines when you have employees. Their spend management software is top-tier. You can issue cards to your team with very specific limits.

For example, you can give your marketing manager a card that only works for "Ads" and has a $5,000 monthly limit. If they try to buy a flight, it declines.

Their rewards program is also tailored to startups. You earn points on ads, software and travel.

The catch

Brex has shifted its focus upmarket. They are less friendly to the "solopreneur" or small indie hacker these days. They often require a certain amount of funding or revenue to unlock their best features.

Relay: The choice for cash flow control

Relay is the underdog that bootstrappers are obsessed with.

While Mercury and Brex focus on "growth" and "yield," Relay focuses on "budgeting" and "clarity."

Why bootstrappers love it

Relay allows you to open up to 20 individual checking accounts for free.

This is perfect for the "Profit First" method. You can have one account for "Revenue," one for "Taxes," one for "OpEx" and one for "Owner Pay."

You can see exactly how much money you have for each purpose at a glance. You never accidentally spend your tax money on a new software subscription.

It also integrates incredibly well with Gusto and QuickBooks. It aims to automate the boring back-office work so you don't need to hire a bookkeeper too early.

The catch

It lacks the flash of Mercury or the high-end rewards of Brex. It is a utility tool, not a status symbol.

Comparison at a glance

| Feature | Mercury | Brex | Relay |

|---|---|---|---|

| Best For | Tech / SaaS | Scaling Teams | Bootstrappers |

| Key Feature | Auto-Treasury (Yield) | Spend Controls | 20 Free Accounts |

| Fees | Mostly Free | Mostly Free | Mostly Free |

| Vibe | Silicon Valley Slick | Corporate Powerhouse | Practical Utility |

| Safety | High (Sweep Networks) | High | High |

Final verdict

You are trusting these platforms with your lifeblood. Make the decision based on where you are going, not just where you are.

Choose Mercury if: You are building a venture-backed startup. You want a "set it and forget it" treasury management system. You value design and user experience above all else.

Choose Brex if: You have a team of 10+ people. You need to control employee spending strictly. You spend heavily on ads and want rewards that actually matter.

Choose Relay if: You are bootstrapped or running a small agency. You want to implement strict budgeting protocols like "Profit First." You want clarity on every dollar that enters and leaves your business.

Open the account this week. Get your routing number. Get back to building.