Do founder obsess over "runway". Perhaps. And perhaps that's not a bad thing.

We calculate our startup’s burn rate down to the penny. We optimize our AWS bills. We negotiate with SaaS vendors. We do everything to keep the business alive for one more month.

Yet, many founders treat their personal finances with a "move fast and break things" attitude that borders on negligence.

If you can’t manage a £5,000 personal monthly budget, you are going to struggle managing a £500,000 seed round. The discipline is exactly the same.

Treating your personal life like a lean startup isn't about being cheap. It is about cash flow visibility. It is about knowing exactly how much time you have to build before you need to panic.

We tested the best tools on the market to help you extend your personal runway and build wealth outside of your equity.

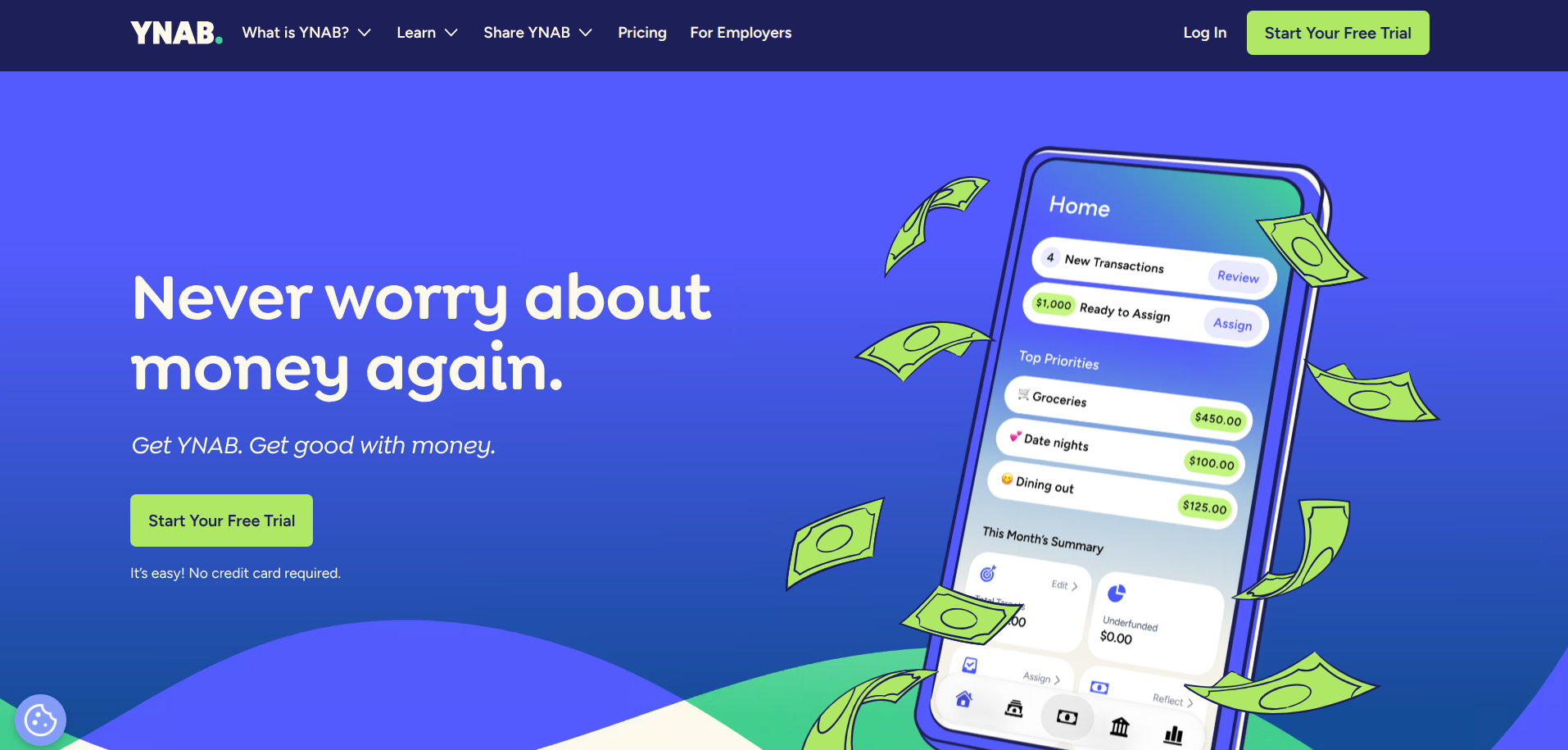

1. YNAB (You Need A Budget)

Best for: The "Zero-Based" Strategist

YNAB is a cult classic for a reason. It forces you to adopt "zero-based budgeting," meaning every single pound or dollar you earn is given a specific job—whether that’s "Rent," "Groceries," or "Holiday Fund."

For founders, this mindset is identical to allocating capital in a business. You stop looking at your bank balance and start looking at your category balances. It changes your behavior immediately.

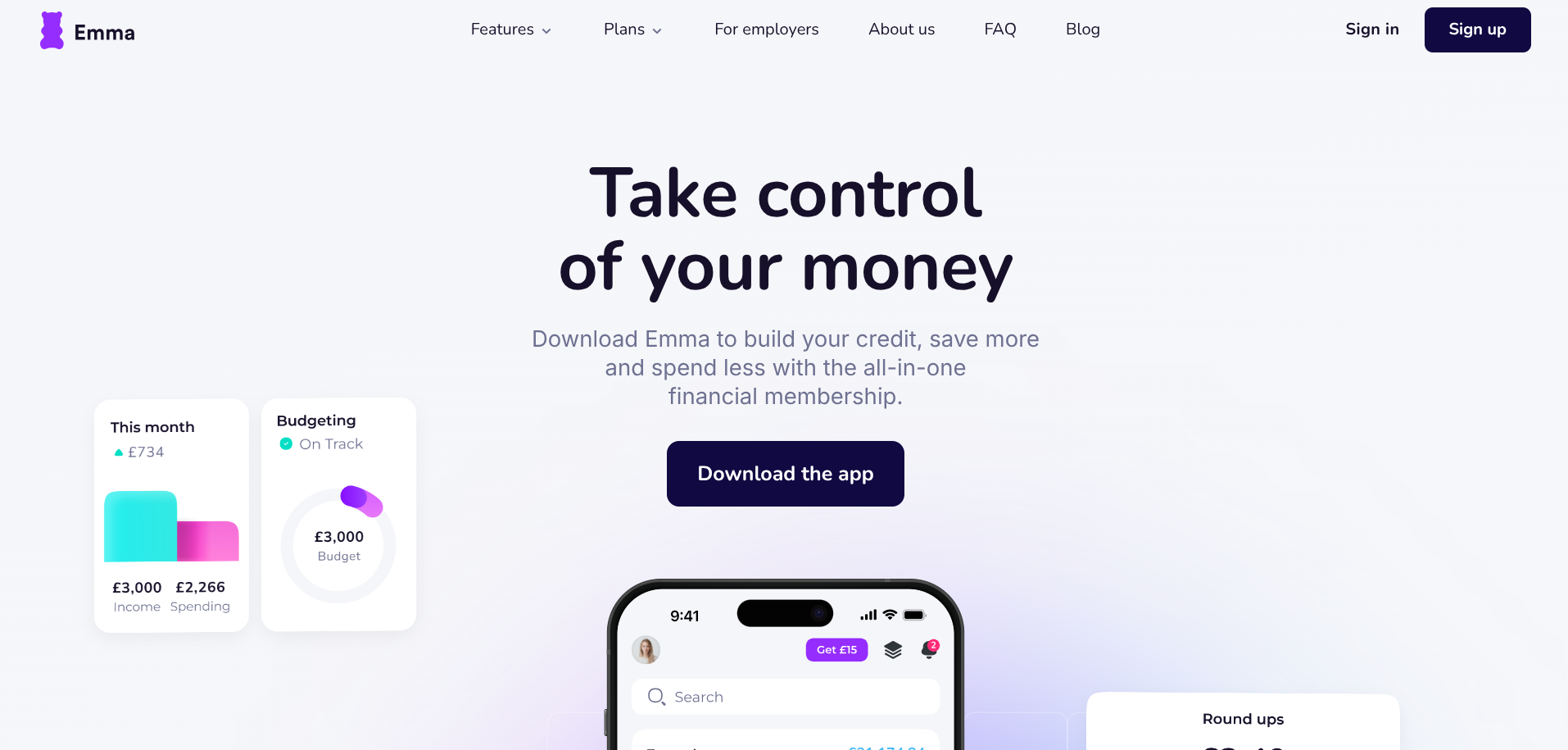

2. Emma

Best for: The Subscription Killer

Founders love subscribing to tools. A $10 Notion AI subscription here, a £20 LinkedIn Premium there. It adds up to a personal high burn rate.

Emma connects to your bank accounts and automatically detects recurring payments. It is ruthless at highlighting wasted subscriptions you forgot about. If you want to cut your personal burn rate in one afternoon, download this.

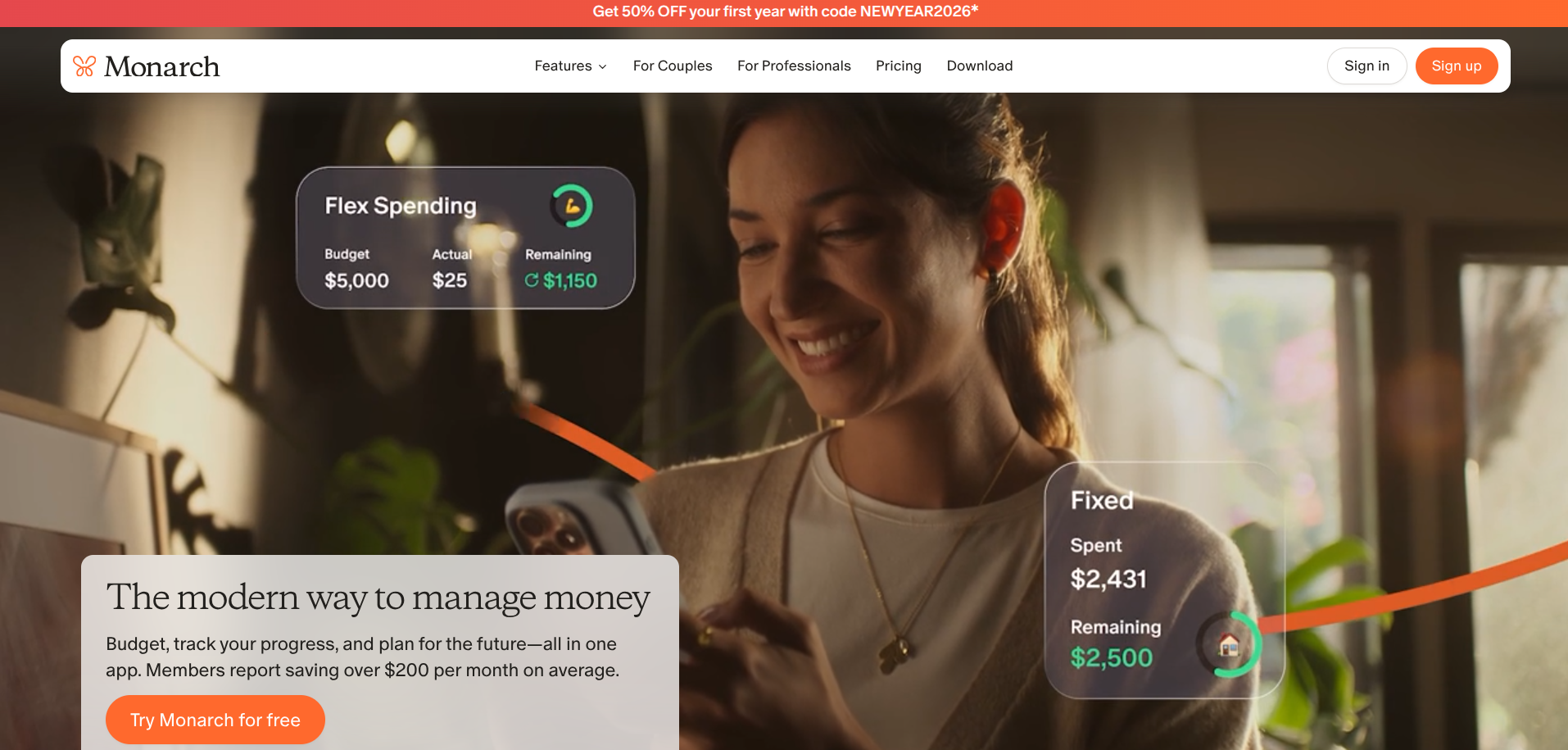

3. Monarch Money

Best for: The Data-Obsessed Founder

Since Mint shut down, Monarch has taken the crown for comprehensive financial dashboards. It was built by product people, and it shows.

It allows for deep customization of categories, excellent investment tracking, and clean visualization of your net worth over time. If you run your life through KPIs and charts, this is your dashboard.

4. Copilot

Best for: The Design-First User

If you appreciate the UI/UX of apps like Linear or Arc, you will love Copilot. It is currently the most beautiful finance app on the market, exclusively for Apple users (Mac/iOS).

It uses AI to categorize spending with surprising accuracy, meaning you spend less time admining your finances and more time building your business. The "intelligence" feels like having a fractional CFO in your pocket.

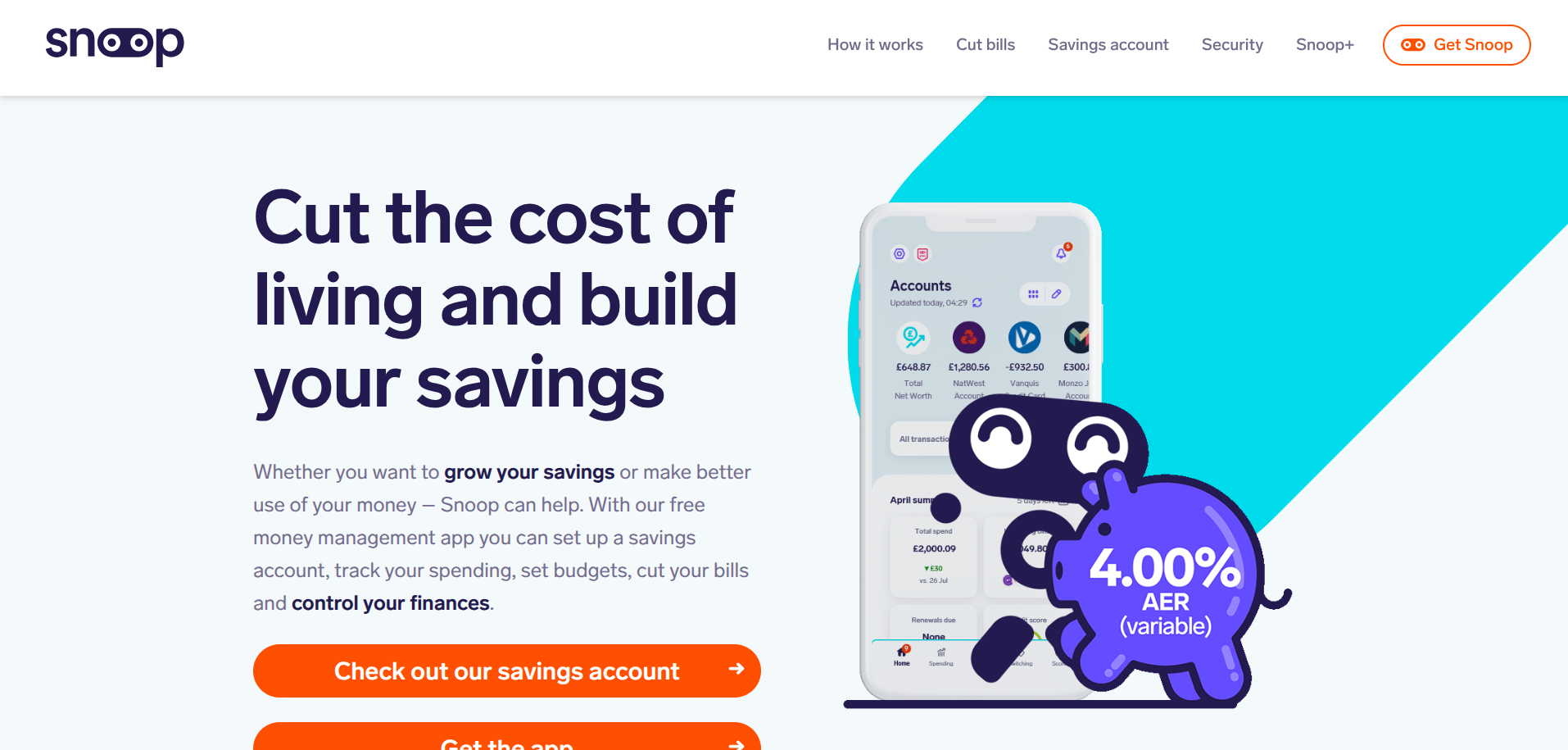

5. Snoop

Best for: Automated Cost Cutting

Snoop is a UK favorite that analyzes your spending to find better deals. It doesn't just track where your money went; it actively suggests where you can save.

It monitors your bills (energy, broadband, mobile) and alerts you when you are overpaying or when a contract is ending. It’s like having an automated procurement department for your house.

6. PocketGuard

Best for: "In My Pocket" Cash Flow

Sometimes you don't want complex charts. You just want to know: Can I afford this dinner?

PocketGuard calculates your income, subtracts your fixed bills and savings goals, and gives you a single number: "In My Pocket." It simplifies the cognitive load of decision-making, which is invaluable when you have decision fatigue from running a company.

7. Revolut / Monzo

Best for: The All-in-One Ecosystem

While technically banks, the "Pots" and "Vaults" features in Monzo and Revolut have become so powerful they essentially replace standalone budgeting apps for many.

For the minimalist founder, keeping your "operating account" (spending) separate from your "holdings" (savings) within one app is efficient. The instant notifications alone are often enough to keep spending in check.

8. Tiller (Excel / Google Sheets)

Best for: The Spreadsheet Power User

Some of us just trust spreadsheets more than apps. Tiller is a powerful plugin that automatically feeds your bank data into Google Sheets or Excel each day.

It gives you the raw data to build your own financial models. If you want to forecast your personal runway using the same complex formulas you use for your startup, this is the tool.

The Founder’s Finance Library

Software is useful, but mindset is permanent. If you want to upgrade your financial operating system, these three books are essential reading for any entrepreneur.

Profit First by Mike Michalowicz

This is technically a business book, but the principle applies perfectly to personal finance. The core thesis: take your profit (or savings) first, and run your operations on what remains. It cures the "spend what you have" disease.

Get Profit First here

The Psychology of Money by Morgan Housel

Startups are high-stress environments. This book teaches you that wealth isn't about IQ; it's about behavior. It helps you detach your ego from your net worth—a critical skill for any founder riding the rollercoaster.

Get The Psychology of Money here

The Algebra of Wealth by Scott Galloway

"Prof G" speaks the language of the modern founder. This book focuses on talent stacking, stoicism, and how to build economic security in a volatile economy. It is pragmatic, harsh, and necessary.

Get The Algebra of Wealth here